Financial Risks

NORMA Group is exposed to several financial risks, including FX, interest, default, liquidity and commodity risks. The Group’s financial risk management strategy concentrates on the identification, evaluation and mitigation of risks, focusing on minimizing the potential negative impact on the Company’s financial, asset and earnings position. Derivative financial instruments are used to hedge particular risk items.

FX Risks

As a company that operates internationally, NORMA Group is active in 100 different countries and is exposed to the currency risk resulting from various foreign currency positions with regard to the most important currencies, the US dollar, British pound, Chinese renminbi, Indian rupee, Polish złoty, Swedish krona, Czech koruna, Serbian dinar and Singapore dollar.

Taking into account the respective risk-bearing capacity of the subsidiaries, Treasury Risk Management seeks to achieve a reasonable hedging level of net foreign currency risks (as a result of taking foreign currency inflows and outflows into account). Highly volatile net foreign currency risks are thus hedged with increased hedging ratios.

Interest Rate Risks

NORMA Group’s interest rate risk arises from borrowings with variable interest rates. These expose the Group to a cash-flow-related interest rate risk, which is partly offset by hedging transactions (interest rate swaps). As there are currently no signs of a more restrictive monetary policy in the eurozone, NORMA Group classifies the risk of interest rate increases for the euro as unlikely in the short term. In the longer term, however, the risk of interest rate increases is assessed as possible. In view of the current low level of interest rates in the eurozone, however, the opportunities that could arise from a further decline in interest rates are assessed as unlikely.

Group Treasury regularly monitors the risk positions and assesses them with regard to their risk-bearing capacity. If certain risk parameters are exceeded, countermeasures are initiated.

Credit Risks

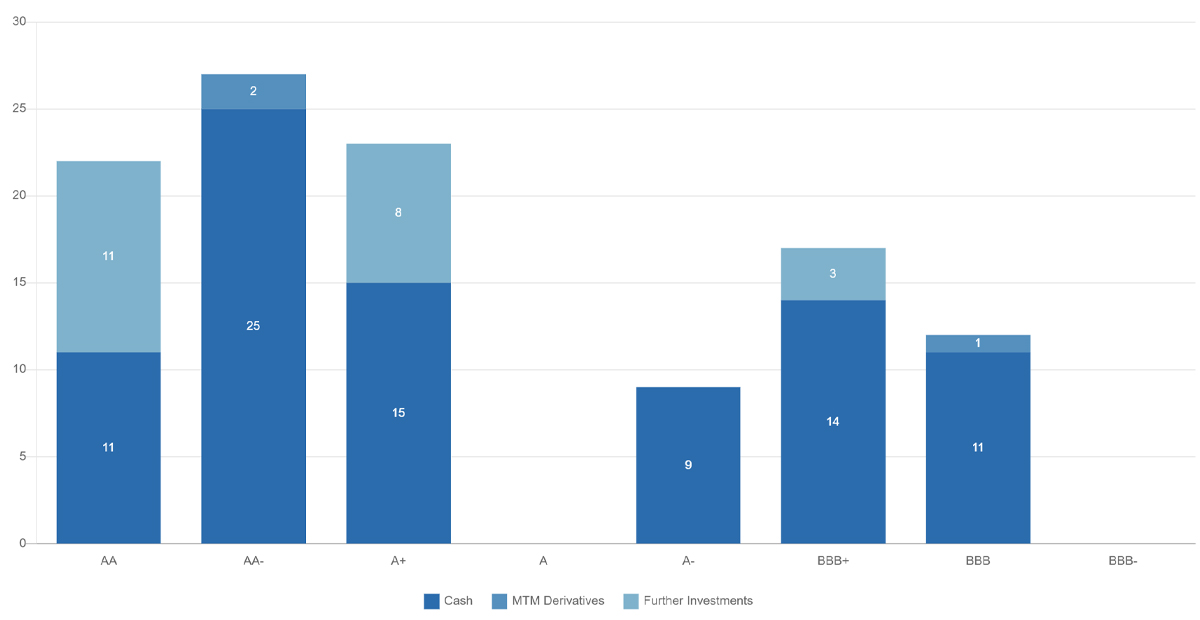

The risk position with regard to credit risk are monitored regularly. For this purpose, all of NORMA’s connected banks are examined in terms assets with one bank, the bank’s CDS and rating. Assets are mostly cash and cash equivalents, short term investments as well as derivatives with a positive market value. Group Treasury reviews the history of CDS and rating for each and every bank above a critical asset threshold. Furthermore Group Treasury checks the general asset allocation of all assets. If all assets are allocated to banks with BBB it might be useful to shift at least a portion to banks with a better rating.

Liquidity Risks

Prudent liquidity risk management requires holding sufficient cash funds or marketable securities, having sufficient financing from committed lines of credit and being able to close out market positions. Due to the dynamic nature of NORMA Group’s business, Group Treasury seeks to ensure flexibility in financing by keeping committed credit lines available. Therefore, NORMA Group’s primary objective is to ensure the uninterrupted solvency of all Group companies. Group Treasury is responsible for liquidity management and thus for minimizing liquidity risks. As at December 31, 2024, cash and cash equivalents amounted to EUR 127.4 million (2023: EUR 165.2 million). In addition, NORMA Group has a high level of financial flexibility thanks to a committed revolving credit line with national and international credit institutions in the amount of EUR 100 million. As at December 31, 2024, the committed credit line was not drawn (previous year: EUR 0 million). In addition, NORMA Group launched a commercial paper program with a total volume of EUR 300 million in 2019, which can be used flexibly to cover short-term liquidity requirements. These money market papers, which are equivalent to bearer bonds, are issued on a revolving basis for a short-term period of 1 to 52 weeks and thus allow for the Group’s own liquidity to be managed in line with requirements. As at 31 December 2024, the commercial paper program with a volume of EUR 0 million (2023: EUR 0 million) was used as a source of refinancing.

The probability of liquidity risks having a negative impact on NORMA Group’s activities is considered unlikely due to the high financial flexibility provided by committed and not yet fully utilized bank credit lines. In the event of (short-term) increased liquidity requirements that exceed currently negotiated lines, the possibilities of raising funds at market conditions, by issuing new bonds on the commercial paper market, for example, are considered to be good, as in the previous year. .

Assets per Rating Class (example)

Commodity Price Risks

The materials NORMA Group uses, in particular the raw materials steel and plastics, are subject to the risk of price fluctuations. The price trend is also influenced indirectly by the further development of the global economic situation as well as by institutional investors.

NORMA Group limits the risk of rising purchase prices through systematic material and supplier risk management. Thanks to a powerful global Group purchasing structure, economies of scale are being used to purchase the most important commodity groups as competitively as possible. This Group purchasing structure also enables NORMA Group to balance out the risks of individual segments with each other. NORMA Group also constantly strives to secure permanently competitive procurement prices by continuously optimizing its selection of suppliers and applying the best-landed-cost approach. The company also tries to reduce dependency on individual materials through constant technological advances and testing of alternative materials. NORMA Group protects itself against commodity price volatility by concluding procurement contracts with a term of up to 24 months, whereby material supply risks are minimized and price fluctuations can be calculated more accurately.