-

About NORMA Group

Company information

Strategy

Corporate Responsibility

-

-

Investor Relations

Management and Corporate GovernanceSharePublications and EventsOnline ReportsFinancial FiguresCreditor RelationsAGMServicesManagement and Corporate Governance

Share

Publications and Events

Online Reports

Financial Figures

Creditor Relations

AGM

Services

- Career

- Blog

- Contact us

-

About NORMA Group

Company information

Strategy

Corporate Responsibility

-

-

Investor Relations

Management and Corporate GovernanceSharePublications and EventsOnline ReportsFinancial FiguresCreditor RelationsAGMServicesManagement and Corporate Governance

Share

Publications and Events

Online Reports

Financial Figures

Creditor Relations

AGM

Services

- Career

- Blog

- Contact us

Welcome to the new NORMA Group website! We are in the process of launching our new website and appreciate your patience as we continue to make improvements.

Maturity Profile

Based on our financing strategy, our focus is on a relatively balanced maturity profile, consisting of bank and capital market financing.

Below you will find an overview of the annual maturities over the next seven years divided by currency mix and financing instruments.

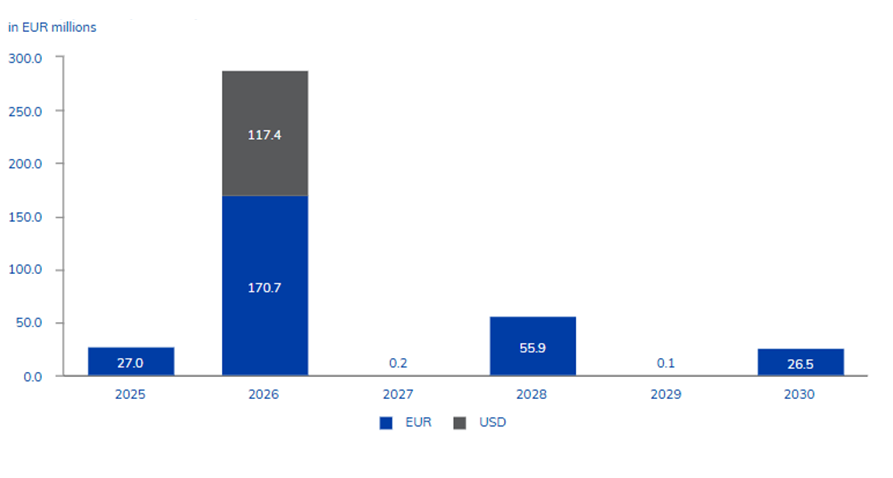

Maturity by currency

NORMA Group strives for a relatively balanced maturity profile. The currency mix US dollar and Euro should be balanced and thus comply with the balance structure and internal cash flows.

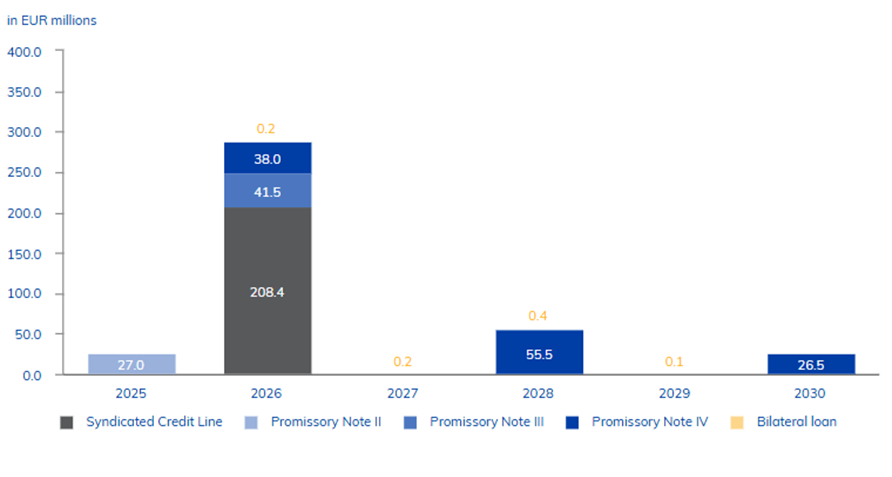

Maturity profile by financial instruments

NORMA Group primarily uses a syndicated bank loan and promissory notes to finance its business activities. In particular, the bank loan includes features to collect money at short notice – for example, for acquisitions.