NORMA Group closes out third quarter 2025 profitably in challenging environment

Note: The business figures in the income statement relate to the continuing business units Industry Applications and Mobility & New Energy. NORMA Group concluded a sale agreement for the Water Management business unit on September 23, 2025, and classified the business as a discontinued operation at the end of the second quarter of 2025.

Maintal, Germany, November 4, 2025

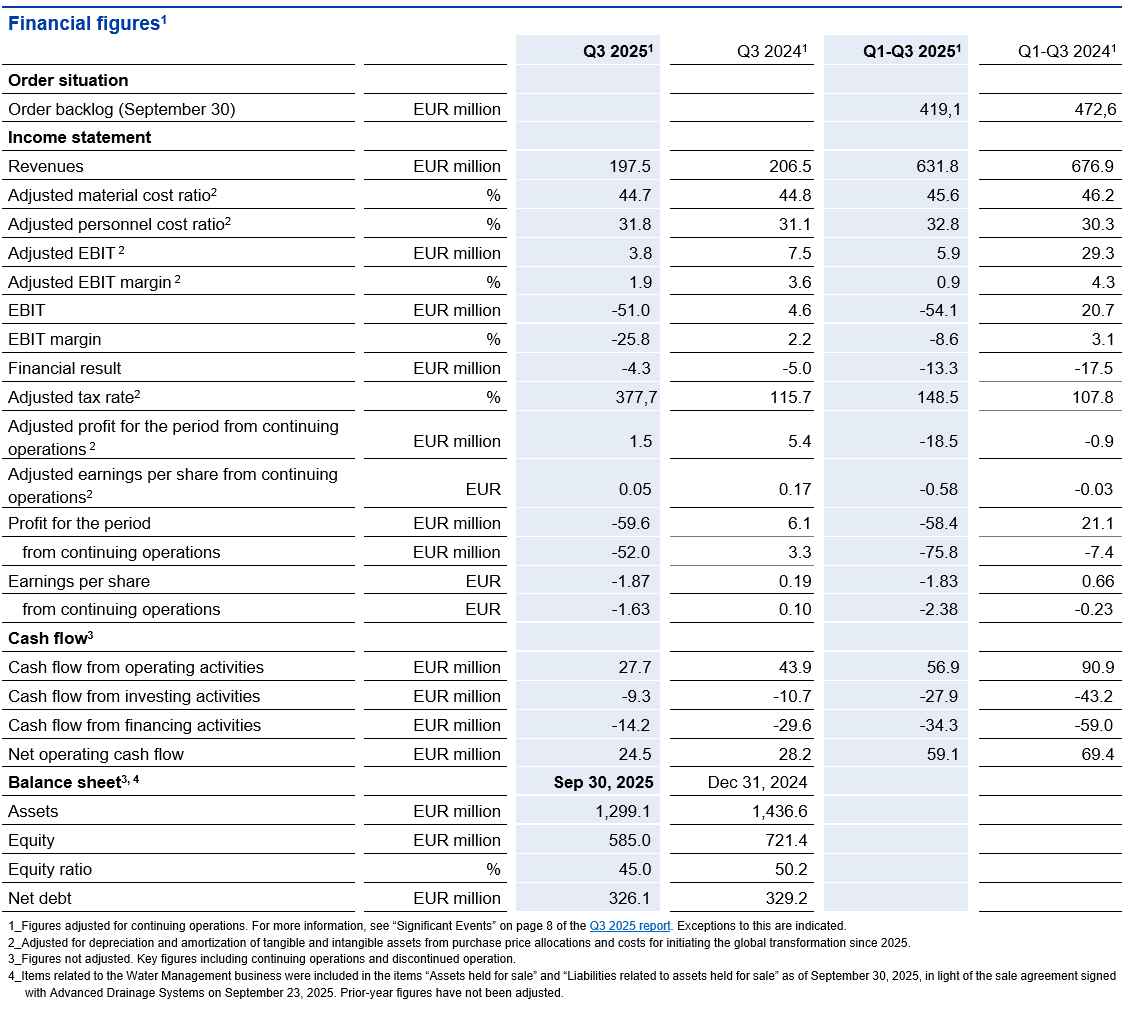

- Q3 2025 sales down 4.3 percent to EUR 197.5 million

- Subdued demand from automotive industry in Europe and America

- Adjusted operating profit (EBIT) at EUR 3.8 million

- Adjusted EBIT margin at 1.9 percent

- New CEO Birgit Seeger since November 1

NORMA Group closed out the third quarter of 2025 profitably despite subdued demand. Business with joining technology for vehicles (Mobility & New Energy) declined as expected and for industry-related reasons. The Industry Applications business showed slight organic growth on the back of strong business development in America.

Group sales in the third quarter of 2025 amounted to EUR 197.5 million and was thus 4.3 percent below the same quarter of the previous year (Q3 2024: EUR 206.5 million). Excluding exchange rate effects (-3.2 percent), the decline amounted to 1.1 percent. Adjusted earnings before interest and taxes (adjusted EBIT) in the third quarter of 2025 were down 49.4 percent over the prior-year quarter at EUR 3.8 million (Q3 2024: EUR 7.5 million). The adjusted EBIT margin was 1.9 percent (Q3 2024: 3.6 percent). It was not possible to fully offset lower sales in the third quarter by flexibilization of costs. Higher personnel costs and special logistics costs, in particular, had a negative impact on earnings and margins. Selective investment activity and measures to increase operating efficiency as part of the “Step Up” program had a compensating contribution to profitability. Net operating cash flow of EUR 24.5 million in the third quarter of 2025 was thus slightly lower than in the prior-year period (Q3 2024: EUR 28.2 million). This is primarily attributable to a lower increase in trade working capital and, to a lesser extent, to lower material costs in the quarter under review.

Birgit Seeger, CEO of NORMA Group since November 1: “NORMA Group’s third quarter results reflect a challenging market environment. We are working to strengthen our competitiveness with strategic measures that include our Transformation 2025–2028 program. We are making targeted investments in efficiency, innovation and customer focus – establishing a foundation for profitable growth in the years ahead. NORMA Group is financially sound and well-positioned to benefit from a market recovery.”

Decline in Europe and America, stable development in Asia

In the EMEA region (Europe, Middle East and Africa), sales amounted to EUR 100.9 million in the third quarter of 2025, down 5.0 percent on the prior-year figure (Q3 2024: EUR 106.3 million). Business with joining technology for vehicles (Mobility & New Energy) suffered from weak demand from the automotive industry. As of financial year 2025, NORMA Group allocates customers in the construction and agricultural machinery and stationary power supply industries to the Industry Applications business unit in order to better manage customer needs (these customers were previously allocated to Mobility & New Energy). Due to this change in allocation, there was nominal growth in the Industry Applications business unit.

In the Americas region, sales in the third quarter of 2025 were down 4.9 percent year-on-year to EUR 66.3 million, due entirely to exchange rate effects (Q3 2024: EUR 69.7 million). Adjusted for the negative currency effects in connection with the US dollar (-6.1 percent), business in America grew by 1.2 percent. Low production figures at US truck manufacturers reduced demand from the American automotive industry. The passenger car business also failed to provide any positive growth momentum in the Mobility & New Energy business unit. Industry Applications generated additional business with spare parts for trucks and acquired a DIY chain as a new major customer for joining technology. Overall, Industry Applications enjoyed strong organic growth in the region.

Business in the Asia-Pacific region developed well in the third quarter of 2025: Adjusted for currency effects, business in the region grew significantly by 6.0 percent. As a result of negative currency effects (-6.7 percent), total sales of EUR 30.3 million were stable compared to the previous year (Q3 2024: EUR 30.6 million). Following a difficult first half of the year, organic growth trends were perceptible again for the first time in the area of joining technology for vehicles. Business in Australia made a positive contribution to sales in Industry Applications.

Development year to date

In the period from January to September 2025, NORMA Group generated sales of EUR 631.8 million in continuing operations. This corresponds to a decrease of 6.7 percent compared to the prior-year period (Q1-Q3 2024: EUR 676.9 million). This includes a negative currency effect of 1.5 percent. Adjusted for currency effects, NORMA Group recorded a 5.1 percent decline in sales in the first nine months of 2025. Sluggish growth in several industries, geopolitical uncertainty and trade conflicts resulted in generally moderate demand for joining technology. The European and Chinese automotive industries in particular showed no significant signs of recovery in the reporting period.

Because fixed costs could not be reduced to the same extent as the decline in sales, there was a disproportionate drop in earnings and margins. Adjusted EBIT amounted to EUR 5.9 million in the first nine months of 2025, a decrease of 79.9 percent compared to the same period of the previous year (Q1-Q3 2024: EUR 29.3 million). The adjusted EBIT margin was 0.9 percent (Q1-Q3 2024: 4.3 percent). The personnel cost ratio in the first nine months of 2025 amounted to 32.8 percent after 30.3 percent in the same period of the previous year. Net operating cash flow amounted to EUR 59.1 million in the period from January to September 2025 (Q1-Q3 2024: EUR 69.4 million).

Goodwill impairment for the EMEA region

The subdued economic situation and low willingness to invest are reducing growth expectations for the joining technology business in Europe. Based on its business planning in the regions over the next years, NORMA Group recognized a goodwill impairment loss of around EUR 50 million in October 2025. The impairment loss relates to the EMEA region and is the result of a mandatory goodwill impairment test. The automotive industry in particular continues to experience low capacity utilization coupled with a high degree of geopolitical uncertainty. The impairment loss is not cash-effective, meaning that it does not result in an outflow of cash. The reduction in goodwill will have an impact on net profit after taxes. NORMA Group will publish its preliminary figures for financial year 2025 on February 17, 2026.

Additional information on the business results can be found here. For press photos, please visit our Press Area.