NORMA Group closes financial year 2025 within the forecast corridors; divestment of water business successfully completed

Note: The business figures in the income statement relate to NewNORMA with the business units Industry Applications and Mobility & New Energy. The Water Management business unit, the divestment of which was completed on February 2, 2026, has been classified as a discontinued operation since the third quarter of 2025.

Maintal, Germany, February 17, 2026

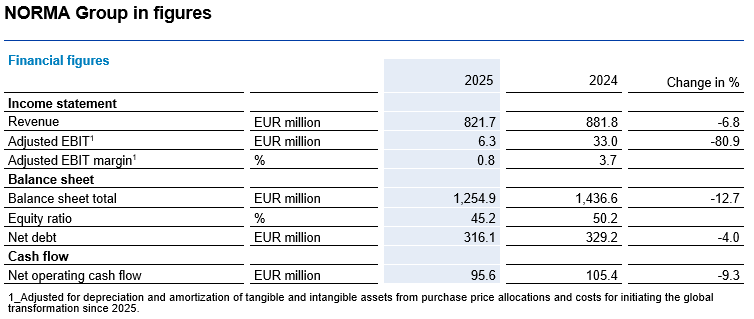

- Preliminary, unaudited figures put sales at EUR 821.7 million for 2025

- Adjusted operating profit (EBIT) at EUR 6.3 million; adjusted EBIT margin at 0.8 percent

- Net cash flow of EUR 95.6 million demonstrates operational strength

- Divestment process for the Water Management business unit successfully completed

NORMA Group met its forecast in financial year 2025. According to preliminary, unaudited figures presented today, the company achieved its targets for sales, EBIT margin and net cash flow in financial year 2025. In February 2026, the company successfully completed the divestment of the Water Management business unit.

NORMA Group generated Group sales of EUR 821.7 million in financial year 2025 – a figure that was within the given forecast (“around EUR 810 million to around EUR 830 million”). The decrease compared to the previous year (2024: EUR 881.8 million) is partly due to negative currency effects of 2.1 percent. General market weakness in key customer industries such as truck production and the construction industry weighed on demand. Weaknesses in the distribution business with connecting components also had a dampening effect.

Adjusted earnings before interest and taxes (adjusted EBIT) was EUR 6.3 million (2024: EUR 33.0 million). High personnel costs and special costs for logistics in particular had a negative impact on earnings and margin. Measures taken to improve efficiency had a positive impact on production and overhead costs, but could only partially offset the effects of the decline in sales. The adjusted EBIT margin of 0.8 percent (2024: 3.7 percent) was at the upper end of the forecast corridor of “around 0 percent to around 1 percent”. Net operating cash flow was again strong at EUR 95.6 million (2024: EUR 105.4 million).

CEO Birgit Seeger: “With the successful divestment of our water business, we have now laid the foundation for NewNORMA. In a persistently difficult market environment, we managed to close out financial year 2025 in line with our forecast, and the measures taken to enhance efficiency are delivering first results. A debt-free NORMA Group with a strong balance sheet and a clear strategic objective is ideally positioned to serve as a stable and reliable partner for our customers, employees and investors – even in challenging economic times.”

Development in the fourth quarter

According to preliminary, unaudited figures, NewNORMA’s Group sales in the period from October to December 2025 totaled EUR 189.9 million, a decrease of 7.3 percent compared to the same quarter of the previous year (Q4 2024: EUR 204.9 million). This figure includes negative currency effects of 4.0 percent. Weaker customer demand weighed on sales volumes in both business units. Adjusted EBIT in the fourth quarter was EUR 0.4 million (Q4 2024: EUR 3.6 million); the adjusted EBIT margin was 0.2 percent (Q4 2024: 1.8 percent).

A clear focus bolsters NORMA Group on its path to becoming an Industrial Powerhouse

NORMA Group successfully completed the sale of its water management business at the beginning of February 2026 and is repositioning itself as an Industrial Powerhouse for connecting solutions. The net cash inflow of EUR 650 million will be used to reduce debt (EUR 300 million) and to strengthen NewNORMA (EUR 70 million). In addition, up to EUR 260 million will be returned to shareholders through a combination of various measures. The global transformation measures launched in May 2025 generated savings of around EUR 4.6 million for the company in the past financial year, as planned.

Further dates: final figures and outlook for 2026

NORMA Group will present the audited, comprehensive figures for financial year 2025 with detailed information on business development and sustainability metrics along with the forecast for the current financial year on March 31, 2026.

The business figures in this press release are preliminary and have not yet been approved by the Supervisory Board or audited by an external auditor. Additional information on the business results can be found here. For press photos, please visit our Press Area.