NORMA Group achieves sound level of profitability in third quarter of 2024 despite sluggish market environment

Maintal, Germany, November 5, 2024

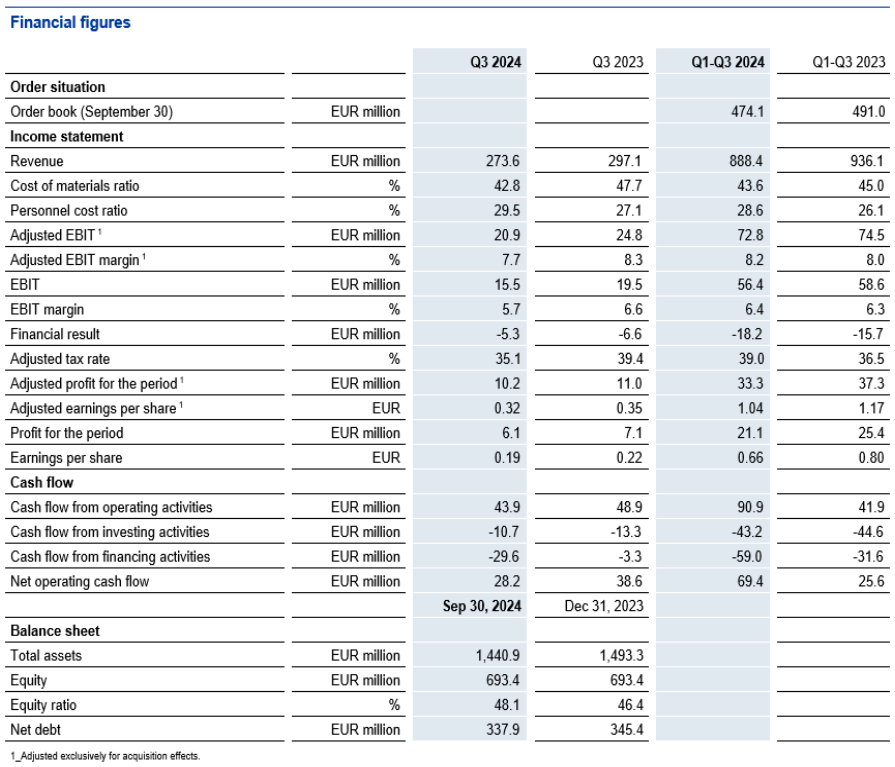

- Q3 2024 sales down 7.9 percent to EUR 273.6 million

- Stable development in water management sector cannot compensate for decline in automotive and industrial sectors

- Adjusted operating profit (EBIT) at EUR 20.9 million

- Adjusted EBIT margin at 7.7 percent

- Forecast for full year 2024 confirmed at Group level; more details provided regarding business regions

NORMA Group achieved a sound level of profitability in the third quarter of 2024 despite a difficult market environment. Business with joining technology for vehicles (Mobility & New Energy) suffered under a weak global automotive industry with low production figures for cars and trucks. Sales in the Water Management sector, on the other hand, remained stable at a high level. The Industry Applications business unit was especially impacted by the persistently weak economy in large parts of Europe and in China.

Group sales in the third quarter of 2024 amounted to EUR 273.6 million and were 7.9 percent below the same quarter of the previous year (Q3 2023: EUR 297.1 million). Currency effects had a negative impact of 0.5 percent, while the acquisition of irrigation specialist Teco, completed at the beginning of 2024, made a positive contribution of 0.2 percent to sales growth. Adjusted earnings before interest and taxes (adjusted EBIT) in the third quarter of 2024 was down 15.6 percent over the prior-year quarter at EUR 20.9 million (Q3 2023: EUR 24.8 million). The adjusted EBIT margin was 7.7 percent (Q3 2023: 8.3 percent). Lower sales and higher personnel costs due to inflation had a negative impact on both earnings and margins. Measures initiated in 2023 to increase operating efficiency as part of the “Step Up” program made a positive contribution to profitability. Net operating cash flow of EUR 28.2 million in the third quarter of 2024 was lower than in the prior-year period (Q3 2023: EUR 38.6 million).

CEO Guido Grandi: “The third quarter presented us with an exceptionally challenging market environment. Macroeconomic trends that included the slowdown in vehicle sales, muted investment in the construction and infrastructure sectors combined with a generally subdued economy in several regions all had an impact on our business volume. Despite these developments, we still managed to achieve a sound level of profitability. We are continuing to implement our 'Step Up' improvement program with discipline and are focusing even more closely on efficiency and growth measures in our three strategic business units Industry Applications, Water Management and Mobility & New Energy.”

Varying development in the business regions

In the Americas region, sales in the third quarter of 2024 fell by 1.2 percent year-on-year to EUR 131.3 million due to negative currency effects in connection with the US dollar (Q3 2023: EUR 132.9 million). Adjusted for currency effects, sales development was slightly positive (+0.1 percent). Business with stormwater and irrigation solutions (Water Management) and the Industry Applications business grew slightly on a currency-adjusted basis. In the Mobility & New Energy sector, however, sales of joining technology for vehicles declined. At the end of September, Hurricane Helene caused short-term business interruptions for some customers on the east coast of the USA.

In the EMEA region (Europe, Middle East and Africa), sales amounted to EUR 108.0 million in the third quarter of 2024, down 9.4 percent on the prior-year figure (Q3 2023: EUR 119.3 million). Business with joining technology for vehicles (Mobility & New Energy) was impacted by lower production volumes for cars and trucks. Development in the Water Management sector was very positive due to the acquisition of Italian company Teco. Teco develops and sells solutions for targeted and, therefore, economical irrigation for gardens, landscaping and agriculture. The Industry Applications business was stable compared to the previous year.

In the Asia-Pacific region, third-quarter sales were down 23.9 percent to EUR 34.2 million (Q3 2023: EUR 45.0 million). Currency effects had a slightly positive impact here. Business with customers in the Chinese automotive industry (Mobility & New Energy) declined significantly. In Industry Applications, sales were lower – due in particular to persistently weak economic development in China. Development in the Water Management business was varied: Demand in Australia continued to develop positively, while business in South and Southeast Asia declined.

Development in the nine-months from January to September

In the period from January to September 2024, NORMA Group generated sales of EUR 888.4 million, representing a decrease of 5.1 percent compared to the prior-year period (Q1–Q3 2023: EUR 936.1 million). This figure includes slightly negative currency effects (-0.5 percent). Adjusted EBIT amounted to EUR 72.8 million in the first nine months of the year (Q1–Q3 2023: EUR 74.5 million). The adjusted EBIT margin of 8.2 percent was higher than the prior-year quarter (Q1–Q3 2023: 8.0 percent). Net operating cash flow was strong in the period from January to September 2024: At EUR 69.4 million, it improved significantly compared to the same period in 2023 (Q1-Q3 2023: EUR 25.6 million).

Forecast for financial year 2024 defined in more detail

NORMA Group confirms key expectations for the current financial year at Group level. Given the challenging market environment, NORMA Group expects sales and profitability at Group level to be at the lower end of the forecast published in March:

- The company expects Group sales of around EUR 1.2 billion.

- In terms of profitability, the company expects an adjusted EBIT margin of about 8.0 percent for 2024.

- Net operating cash flow is expected to be in the range of around EUR 80 million to EUR 110 million.

The company has provided more details regarding its sales forecast for the business regions:

- For the Americas region, NORMA Group expects sales in the range of around EUR 540 million to EUR 550 million in 2024.

- For the EMEA region, NORMA Group forecasts sales in the range of around EUR 480 million to EUR 500 million in 2024.

- In the Asia-Pacific region, NORMA Group expects sales in the range of around EUR 140 million to EUR 150 million in 2024.

Other dates and additional information

NORMA Group will publish preliminary figures for financial year 2024 on February 11, 2025. Additional information on the business results can be found here. For press photos, please visit our Press Area.